IT CONTRACTORS INSURANCE

in partnership with

Your Proof Of Cover

IT contract and consultancy work often comes with the condition of requiring proof of insurance. Start your cover now and have instant access to the proof you need. Professional Indemnity, Public Liability and more.

PROFESSIONAL INDEMNITY ANNUAL PREMIUM

This quote is for a UK-based business covering their Professional Indemnity for up to £100,000 based on an annual turnover of up to £250,000.

IT CONTRACTOR INSURANCE

Professional Indemnity Cover for up to £5million legal expenses

An IT contractor may need protection for professional indemnity risks, such as consultancy work, so this insurance can be considered key cover. Whether you’re offering professional skills or expert advice, you may need to defend yourself against legal action if a client believes you’ve made a mistake. PI insurance can help with the cost of defending and settling claims when a business you work with says your error has lost them money or damaged their reputation.

What’s covered with Rubber Ring PI Cover…

Professional negligence is a legal term that refers to a failure by a professional to provide a standard of care that was expected of someone in their field. In the context of IT contractors, professional negligence could occur if you as the IT contractor failed to provide services that met the required standard of care. This could include situations where you have made errors or omissions in your work, or provided advice or recommendations that were not suitable for the client's needs. In general, IT contractors have a duty to exercise the same level of care and skill as a reasonably competent IT contractor in the same field would use under similar circumstances. If an IT contractor failed to meet this standard of care, they may be found to have been negligent in their professional duties.

This refers to a situation where an IT contractor makes a statement that is untrue or misleading, and this statement causes a client or third party to suffer a loss.

For example, if an IT contractor advises a client to purchase a certain software system, and the software system does not meet the needs of the client as described by the IT contractor, the IT contractor may be found to have made a negligent misstatement or misrepresentation. Similarly, if an IT contractor provides incorrect information to a client about the capabilities of a particular piece of software, and the client relies on this information to make a business decision that results in a loss, the IT contractor may be held liable for negligent misstatement or misrepresentation.

A defamation claim against an IT contractor can arise if the IT contractor makes a statement that damages the reputation of a client or third party. In order to succeed with a defamation claim, the person bringing the claim (the plaintiff) must show that the IT contractor made a false statement of fact about them, that the statement was published to a third party, and that the plaintiff suffered harm as a result of the statement.

Defamation can take two forms: libel and slander. Libel refers to a written or published defamation, while slander refers to a spoken defamation. In the context of IT contractors, a defamation claim could arise if the IT contractor makes a false statement about a client or third party on their website, in an email, or on social media, for example.

It's worth noting that there are defenses to defamation claims, including the defense of truth (meaning that the statement made by the IT contractor was true), and the defense of privilege (meaning that the statement was made in the context of a protected activity, such as a legal proceeding).

A breach of confidence claim against an IT contractor can arise if the IT contractor discloses sensitive or confidential information to a third party without the appropriate authorization. In order to succeed with a breach of confidence claim, the person bringing the claim (the plaintiff) must show that the IT contractor had a duty to keep the information confidential, that the IT contractor disclosed the information to a third party, and that the disclosure caused the plaintiff harm.

IT contractors may owe a duty of confidence to their clients or to other parties with whom they have a professional relationship. This duty may arise from a contract, such as a non-disclosure agreement, or it may arise from the nature of the relationship between the IT contractor and the other party. For example, if an IT contractor is hired to work on a client's website, the IT contractor may owe a duty of confidence to the client with respect to any confidential information that the IT contractor learns about the client's business while working on the website.

If an IT contractor breaches this duty of confidence by disclosing the confidential information to a third party without the appropriate authorization, the IT contractor may be held liable for a breach of confidence. This can include situations where the IT contractor intentionally discloses the information, as well as situations where the IT contractor accidentally or inadvertently discloses the information.

A breach of copyright claim may be brought against an IT contractor if they use someone else's copyrighted material without permission. The plaintiff must show that they own the copyright and that the IT contractor used the work without permission. This can include using software, images, or other copyrighted materials in their work without the appropriate licenses or permissions. There are defenses to copyright infringement, including fair use.

Why might you need this cover?

The majority of IT contracts require Professional Indemnity cover to enable commence work.

Public Liability Cover

Public liability is a form of business insurance designed to cover compensation or legal costs if members of the public or customers claim they have experienced personal injury or damage to their property as a result of your work.

What’s covered with Rubber Ring PL Cover…

Public liability insurance covers IT contractors for claims made by third parties for injury or damage that occurs as a result of the IT contractor's business activities. If an IT contractor is found to be legally responsible for an injury or damage that occurs to a third party, the IT contractor may face a public liability claim.

For example, if an IT contractor is working on a client's computer and drops a heavy object on the client's foot, causing injury, the client may be able to bring a public liability claim against the IT contractor. Similarly, if an IT contractor is working on a website and includes a link to a third party website that contains malicious content, and a user of the IT contractor's website is infected with malware as a result, the user may be able to bring a public liability claim against the IT contractor.

Public liability insurance can help IT contractors to protect against the financial consequences of such claims.

For example, if an IT contractor is building a physical storefront for a client and fails to properly secure the construction site, resulting in injury to a passerby, the passerby may be able to bring a public liability claim against the IT contractor.

For example, if an IT contractor is working on a client's computer and drops a heavy object on the client's computer, causing damage to the computer, the client may be able to bring a public liability claim against the IT contractor for the cost of repairing or replacing the damaged computer.

Alternatively, an IT contractor is hired to install a new security system at a retail store. While installing the system, the IT contractor accidentally cuts a water pipe, causing water damage to the store's inventory and fixtures. The store owner may be able to bring a public liability claim against the IT contractor for the property damage caused by the water leak.

What’s the difference between public liability and professional indemnity insurance?

Public Liability insurance covers you against accidental injuries caused to other people from your business/products as well as any damage caused to a third party’s property.

Professional Indemnity insurance covers you for the financial loss your client may have suffered as a result of your bad advice, poor services or inadequate designs that ended up resulting in financial loss for that client.

UK & Worldwide Business Equipment Cover for up to £5,000

With this add-on cover to your business insurance, you’ll get protection for laptop, mobiles and other essential work tech as well as any other equipment needed to keep your business running efficiently.

Cover Highlights...

Business equipment insurance can cover IT contractors for losses resulting from the theft of business equipment. This can include the cost of replacing stolen equipment, as well as any associated business interruption costs that may result from the theft.

Business equipment insurance can provide IT contractors with peace of mind, knowing that they have protection in place if their equipment is damaged or destroyed.

Business equipment insurance can cover IT contractors for losses resulting from the loss or damage of business equipment. This can include the cost of replacing lost or damaged equipment, as well as any associated business interruption costs that may result from the loss or damage.

Why might you need this cover?

The insurance protects you wherever you are in the UK, which means that you’ll be covered if you’re travelling for meetings or to meet suppliers and lose your equipment when you’re on the road. You also have the option to extend this to worldwide coverage.

Employer's Liability Cover for up to £5million

This add-on can pay the compensation amount and legal costs if an employee, or an ex-employee, claims compensation for a work-related illness or injury. Employer’s liability insurance covers full-time and part-time employees, any self-employed contractors you hire, temporary staff, apprentices, volunteers, and people taking part in work experience or training schemes.

What’s covered with Rubber Ring EL Cover…

If your employee is injured or becomes ill as a result of their work, and you as the employer is found to be legally responsible for the injury or illness, the employer's liability insurance may cover the costs associated with the employee's claim for compensation. It may also cover other expenses, such as the cost of rehabilitation or retraining, and may provide for ongoing payments if the employee is unable to return to work.

If you or one of your directors, partners, or employees need to attend court as a result of a claim against your business, you'll be covered for up to £250 per day in compensation. This coverage applies if court attendance is required in connection with a claim against your business.

If you have any temporary employees, they will automatically be covered by your employer's liability insurance for up to 50 man days. This means that the insurance will cover any claims made by these employees for injury or illness that occurs as a result of their employment. The coverage applies on a per-person basis, so if you have multiple temporary employees, the insurance will cover a total of 50 days' worth of work across all of the employees. For example, if you have 1 employee who works for 50 days, 5 employees who work for 10 days each, or 50 employees who work for 1 day each, all of these employees will be covered under the policy.

System Failure

System Failure

If a customer's system goes offline due to untested patches in an operating system update, you may be the first point of contact for finding a solution. However, you may also be held responsible for the issue. Even if you act quickly to get the customer's system back online, they may decide to make a claim against you for revenue lost during the downtime. They may argue that you should have used simulations to test for the possibility of software failure. In situations like this, where a genuine mistake or miscommunication can lead to legal action against an IT contractor, professional indemnity insurance can provide coverage for defense costs and settlement expenses.

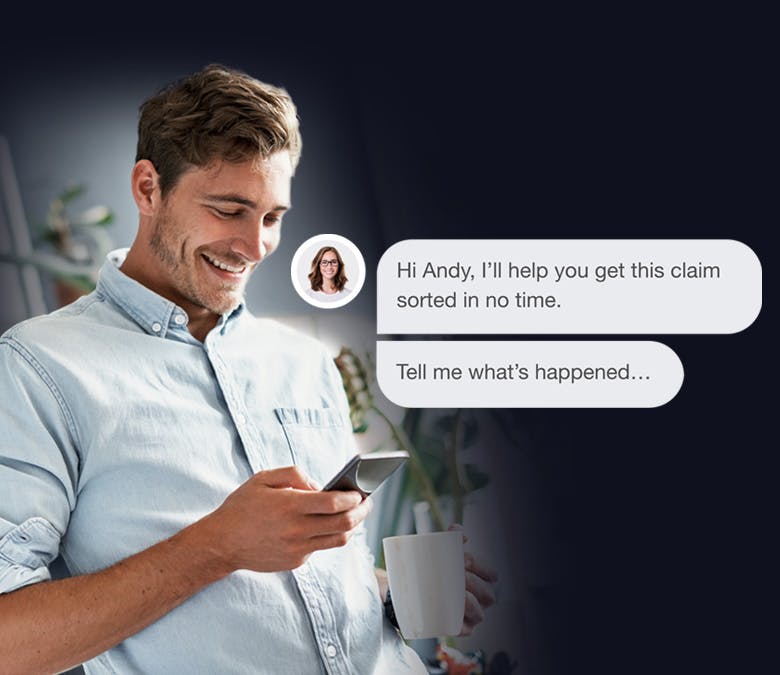

Making a claim is the most important journey you will have with us.

Log your claim instantly from your Rubber Ring Account. Show us any damage with video and pictures immediately through you phone and tell us what happened. All data is sent automatically to our claims team who assess the information and will call you with the next steps.