Sharper Insurance Designed Exclusively For Barbers

The art of barbering, by its very nature, means you’re at the cutting edge. Not just when it comes to the kit you use, the techniques you need to master, or the things you need to do to make sure your shop design is as sharp as your scissors; but also when it comes to business essentials like insurance. Premiums start at just £000 a year!

No commitment, cancel anytime.

BARBER INSURANCE

A policy that is a cut above the rest!

£5million cover for your barber business from just £000 per year

You told us that most newly-trained barbers have to wait at least two years before being fully covered for providing cut-throat shaves. That’s why we include cover from day one* for cut throat shaving, giving keen newly-qualified barbers the opportunity to put their training into action from their very first day. Just don’t tell your customer.

Cover Highlights...

£5million cover for your business if a member of the public gets hurt; or if their property is damaged in the course of you carrying out your business activities (where it’s proved you’ve been negligent).

A legal obligation should you have any employees, covering any injuries they incur during the course of their employment where it’s proved you’ve been negligent.

Stock levels vary for every barber. This covers you for any loss caused by an insured peril and enables you to replace the stock in the event of a claim.

This covers the loss of income from being unable to work as a result of an insurable claim, such as fire, flood and storm.

Get the full lowdown on what’s covered and what’s not covered in the

Insurance Product Information Document | Rubber Ring Contents

Are you a student? Our cover limits are slightly different for you:

Go to STUDENTS Insurance

Cut-throat shaving cover is included as standard on our Barber Insurance policies

You told us that most newly-trained barbers have to wait at least two years before being fully covered for providing cut-throat shaves. That’s why we include cover from day one* for cut throat shaving, giving keen newly-qualified barbers the opportunity to put their training into action from their very first day. Just don’t tell your customer.

* To qualify for insurance, all employees who practice open blade shaving must be 18 or over, and hold relevant certificates and/or qualifications for the treatments provided, as laid down by the governing body.

Barber Insurance For Barbershops

Barber Insurance For Barbershops

Rubber Ring’s contents policy is designed to be flexible, whether you’re in a long or shorter-term rental. You can cover all the stuff that makes your house a home, like your armchair, bedside table and trinkets, as well as things like your laptop and bike.

Our Contents Insurance for tenants is customisable, so you only pay for the cover you need. Flexible cover levels and add-ons to your core policy mean you can tailor your Contents Insurance to suit you.

You can pay for your cover monthly or annually, whichever works best for you. Both options offer you flexibility and free online changes. If you pay monthly we don't charge interest!

Tenants Liability Insurance is included at no extra cost, and it covers your landlord’s property against damage during your tenancy.

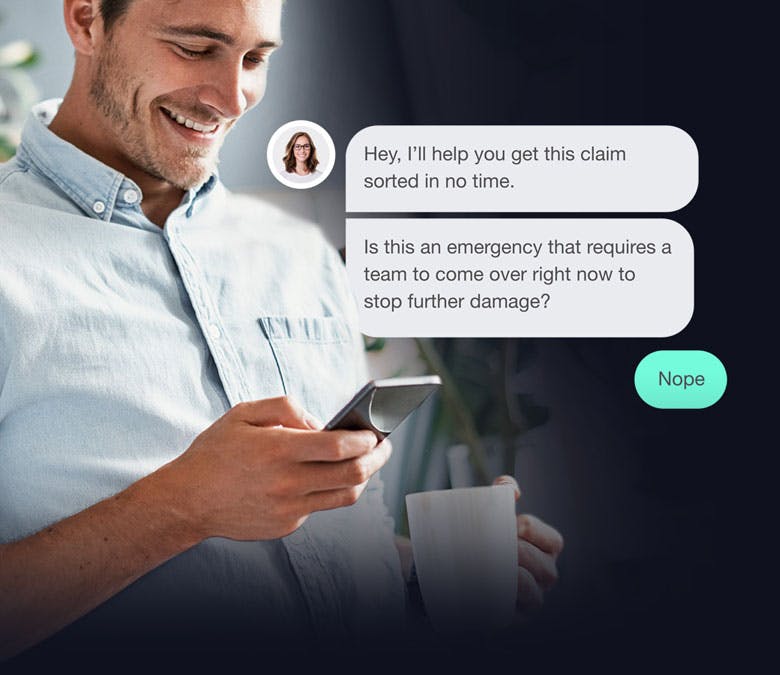

Making a claim is the most important journey you will have with us.

Log your claim instantly from your Rubber Ring Account. Show us any damage with video and pictures immediately through you phone and tell us what happened. All data is sent automatically to our claims team who assess the information and will call you with the next steps.

Still unsure?

Take a look at our FAQs or get in touch